In the Tax Law the Definition of Gross Income Is

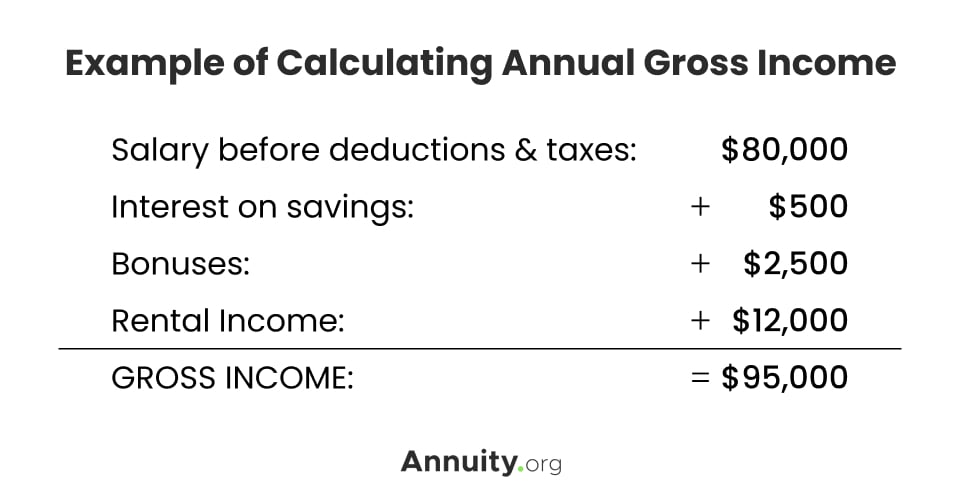

There have been some arguments that consumer law is a better. For households and individuals gross income is the sum of all wages salaries profits interest payments rents and other forms of earnings before any deductions or taxesIt is opposed to net income defined as the gross income minus taxes and other deductions eg mandatory pension contributions.

What Is Adjusted Gross Income H R Block

Up to specified dollar limits cash contributions to the HSA of a qualified individual determined monthly are exempt from federal income tax withholding social security tax Medicare tax and FUTA tax if you reasonably believe that the employee can exclude the benefits from gross income.

. And that during that tax year the members of the affiliated group together had an average number of 90 employees and that for the same tax year the members of the groups total gross receipts were 9000000. Sales of goods. It covers the application of existing tax laws on individuals entities and corporations in areas where tax revenue is derived or levied eg.

Special Considerations. For a firm gross income also gross profit sales profit or credit sales is the. Calculate gross receipts by adding all revenue received within a tax year without subtracting.

Keep in mind that there are limitations on some deductions. The loan to the business is a small business loan for purposes of. For 2022 you can contribute up to 3650 for self-only coverage under an HDHP or.

Tax law is part of public law. In the case of any transfer of property subject to gift tax made before March 4 1981 for purposes of subtitle A of the Internal Revenue Code of 1986 formerly IRC. The law amends the Philippine corporate income tax and incentives system in a bid to attract increased foreign investment and help the Philippine economy recover from the COVID-19 pandemic.

1 et seq gross income of the donor shall not include any amount attributable to the donees payment of or agreement to pay any gift tax imposed with. Generally gross receipts is all revenue that your business received during a given year from. Any deduction allowable under this chapter for attorney fees and court costs paid by or on behalf of the taxpayer in connection with any action involving a claim of unlawful discrimination as defined in subsection e or a claim of a violation of subchapter III of chapter 37 of title 31 United States Code or a claim made under section 1862b3A of the Social Security Act 42 USC.

The bank further determines that for the 2016 tax year the business was part of an affiliated group. Other income producing assets or activities. Gross income is gross receipts minus returns and allowances minus costs of goods sold.

The law 2 is set to take effect on 11 April 2021 that is 15 days after its complete publication unless specifically provided in the law. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. For example current federal tax law limits the mortgage interest deduction to a maximum of 750000 of secured.

Income tax estate tax business tax employmentpayroll tax property tax gift tax and exportsimports tax.

Gross Income What Is Gross Income Why Is It Important

How To Do Taxes I Mean How To Compute Taxable Income Tax Http Www Irstaxapp Com How To Do Taxes I Mean How To Compute Income Tax Income Tax Brackets

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Seca Tax Definition Eligibility Limits Exceldatapro Federal Income Tax Adjusted Gross Income Tax Deductions

0 Response to "In the Tax Law the Definition of Gross Income Is"

Post a Comment